Estimating Future Interest Income From Russia’s Frozen Reserves

This is a joint post with Michael Weilandt. It was revised substantially after initial publication in response to helpful comments from Martin Sandbu, and additional information about the likely scope of any G-7 agreement.

The debate over how to best use the stock of immobilized Russian reserves to support Ukraine seems to be nearing a conclusion. The G7 finance ministers have agreed to explore how to use the future interest income on the “frozen” reserves to provide immediate support for Ukraine. The G7 leaders appear poised to announce a commitment pull forward a large sum of future interest income to assure financial support for Ukraine in 2025, after the current U.S. aid package is likely to be exhausted.

More on:

This compromise emerged after outright seizure of the assets ran into significant European opposition, and Europe’s position really matters here since most of the immobilized reserves that have been identified are in European custodians. The U.S. therefore cannot unilaterally seize most of the immobilized assets.

But once a bond in Russia’s immobilized portfolio matures, the interest income currently doesn’t fall into Russian ownership. Maturing bonds held in custodians like Euroclear roll over into a non-interest-bearing deposit account, and the custodians now generate substantial interest income investing frozen Russian funds that are trapped in these accounts. Using the stream of interest income doesn’t cross Europe’s red line: the principal remains an asset of the Central Bank of Russia (CBR); the income is already going to European custodians (rather than to Russia), and is thus currently subject to European taxation. The legal issues with imposing a punitive tax on these windfall profits are modest.

The U.S. has recognized that mobilizing the interest allows a financially creative G7 scope to raise a substantial sum of money to support Ukraine. After all, it is financially rather straightforward to borrow against expected future interest income. The U.S. does need the EU to modify the sanctions so that they are not subject to a vote on renewal every 6 months. But this should be relatively easy. The G-7, including the European Commission, have already committed to maintaining the sanctions on the central bank until Russian forces are withdrawn from Ukraine.

What isn’t yet clear, though, is just how much interest income the immobilized Russian assets will generate, and thus the financial structure needed to pull forward expected future income.

Our analysis (detailed below) suggests that it should be fairly easy to lock in an income stream of €9 billion off the identified stock of €260 billion in immobilized assets. The €191 billion Euroclear account alone, at current deposit interest rates, should generate close to this sum. But locking in €9 billion over time will likely also require finding new ways to tax the interest income on the €70 billion not held at Euroclear, which implies a broader tax on the income on immobilized reserve assets. There is no strong legal reason though why this income has to accrue to the CBR’s immobilized estate.

More on:

It is now clear that €3 billion number that the Commission has often used is out of date. It was always a small number, as implied by an interest rate of only a bit over 1 percent on the €260 billion of the identified, already immobilized assets. And we now know why it was so small.

First, it excludes the tax revenue Belgium received on the immobilized Euroclear assets. Adding that brings Euroclear’s interest income up to €5.5 billion in 2023.

Second, the income stream on the immobilized reserves grows over time as a rising share of the immobilized bonds held in European custodians mature, as the Financial Times detailed recently. The income stream in 2024 will be substantially larger than in 2023.

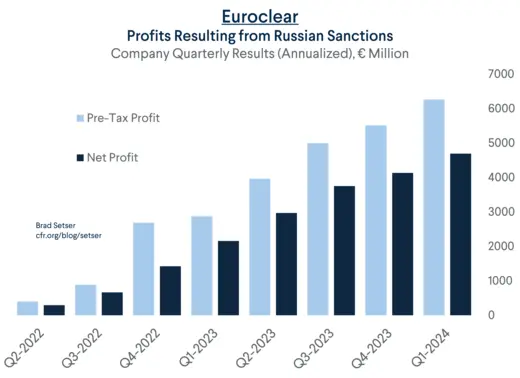

Euroclear’s latest report shows €159 billion in cash from already matured Russian assets (which they break out clearly from “underlying” cash balances), leaving €32 billion of the €191 billion to mature. In the first quarter, Euroclear reported an annualized €6 billion in income on those assets. Simple extrapolation at current interest rates would bring that total to €8 billion as the full Euroclear portfolio matures.

Admittedly, there is a risk that the rate on the euro assets, in particular, could fall. More on that later.

Third, the income on the €70 billion (roughly a quarter) of the €260 billion in identified frozen assets has not been included in the Commission’s estimates.

The G-7 is reportedly focused (for now) on the low-hanging fruit from the Euroclear account, which alone is three quarters of the identified total. Over time, additional interest income streams should be realized on the remaining €70 billion. There are more complex legal issues on these assets, as in some cases the funds were already in deposit accounts that do not have a formal maturity date. But there is no strong legal reason why all the interest income on the immobilized Russian assets could not be subject to more punitive taxation and thus not simply accrue to the CBR estate.

The €260 billion sum is itself smaller than earlier estimates of the immobilized assets based on the CBR’s own pre-war disclosure. The CBR’s standard end-December reserve disclosure showed $630 billion dollars in reserve assets – or €557 billion. After netting out gold and IMF accounts, the CBR reported €410 billion in foreign currency assets, including €267 billion in securities. The roughly €90 billion held in Chinese yuan has clearly not been immobilized, but this accounting still suggests that there were €333 billion or so in foreign currency assets subject to sanctions at the end of December 2021.

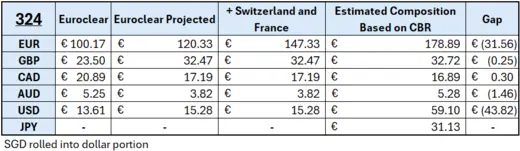

Martin Sandbu used the more detailed disclosure of currency shares provided by the CBR’s annual report to benchmark Russia’s foreign currency assets. The annual report showed $613 billion in foreign assets (including gold) end of 2021. After netting out gold, Sandbu estimated that Russia’s central bank should have had €425 billion in foreign exchange at the end of 2021, and €332 billion net of estimated yuan holdings using end of 2021 exchange rates. Excluding the yuan assets, 55 percent of those assets were in Euro, 18 percent in dollar, 10 percent in pound, 10 percent in yen, and 5 percent were in Canadian dollars. The remaining 2 percent was in Australian and Singaporean dollars. At end-March 2024 exchange rates, the total in euros falls just a bit, to €324 billion (mostly because of the yen's depreciation).

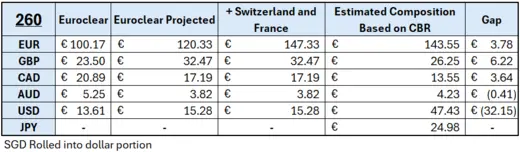

These currency shares can be compared to the shares that Euroclear reports on its deposit accounts. There are some important differences. Notably, Euroclear reports a euro share of over 60 percent. Euroclear’s most recent quarterly report showed a tick up in the share of GBP, and the pound’s 17 percent share now tops the 8 percent dollar share. Surprisingly, the Canadian dollar’s share is also a bit higher than the U.S. dollar share.

In the absence of better information, we assume that the currency composition of the rest of the €191 billion is similar to the composition of already matured assets.

Sandbu also noted that the French report holding €19 billion in immobilize assets and the Swiss report holding another €8 billion. The Swiss claims are technically reported in Swiss francs, but Sandbu assumes that these are euro claims.

As the table above shows, adding these numbers to the assumed total for Euroclear would more than account for estimated holdings of euros and pounds implied by applying the estimated currency share data from end-2021 to the €260 billion in identified assets. To estimate the interest income on the full €260 billion, we thus assume that the remaining undisclosed portfolio is basically entirely in dollars and yen.

Of course, there are other possibilities. For example, the remaining €32 billion in Euroclear itself may have a higher dollar share than the initial €159 billion. Or, more likely, the CBR may have reduced its dollar share between the end of 2021 and the actual invasion of Ukraine (Russia had long worried that the U.S. would freeze any dollar reserves held in the United States).

The bigger stock of €324 billion, of course, would imply more holdings of assets in all the major non-yuan currencies, and more future interest income.

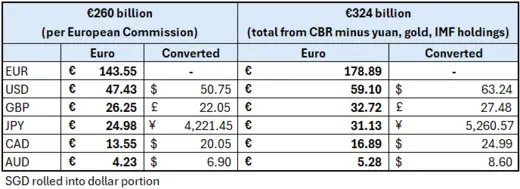

At current policy rates of the given currencies, the interest income from €260 billion would be close to €12 billion. That includes interest income that is not in the Euroclear account and thus is now likely still accruing, at least in part, to the immobilized CBR estate.**

To model the income from investing the assets into bonds, we apply the end-2021 currency shares implied by the CBR’s end-2021 disclosure to both the identified €260 billion and the potential €324 billion.

To lock in a steady future income stream, Euroclear and other custodians could be required to invest in a special “frozen assets income fund” that is itself invested in a currency-matched portfolio of 5- and 10-year sovereign bonds. The income streams from expected future taxation of frozen deposit accounts (the non-Euro clear funds) could be swapped into fixed rates as well.

To be sure, this means investing in some less liquid assets subject to interest rate risk, and thus introduces a tiny element of risk should the underlying assets be freed in any future deal. But if the funds are invested in classic reserve assets, the G7 central banks can always ultimately provide Euroclear with immediate liquidity should the Euroclear assets be unfrozen.

The broader point is simple: maturity transformation with the financial backing of the G7 should be possible if that is needed to make the broader deal work.

Our calculations suggest that investing the full €260 billion in 5-year bonds should generate €9 billion, which rises to €10 billion if invested in 10-year bonds.***

If the total stock of immobilized assets is closer to the €324 billion estimate, the income from a fixed income portfolio rises to around €13 billion from 5-year bonds, and around €15 billion per year in 10-year bonds. ****

Bottom line: a compromise that makes use of the interest income stream is not a weak compromise, and under realistic assumptions, it can safely generate an interest income stream sufficient to back the $50 billion headline loan that has been mentioned in the press.

* Legally, Euroclear is blocked from following Russian instructions on the reinvestment of proceeds, so the maturing funds are placed by default in a Euroclear deposit account – which Euroclear lends, generating a profit from financial intermediation.

** A full accounting of the CBR immobilized estate should include an estimate of the interest income on the bonds held at Euroclear before they matured, and the interest income on the non-Euroclear accounts. Given that there is already a large gap between the number used by the Commission and the numbers implied by the CBR’s end-2021 disclosure, we ignore this complexity.

*** We use a mix of equal parts Spanish, French, and Italian bonds for the euro. For the U.S. dollars: 5-year Treasuries and MBS (rather than 10-year Treasuries).

*** An additional technical detail:

The known euro holdings (that is, Euroclear + French reported + euro-denominated Switzerland claims) line up rather closely with the totals implied by the CBR’s disclosure. Our estimate of known euro assets suggests €120 billion at Euroclear, plus €27 billion from France and Switzerland. The resulting €147 billion total is higher than the €143 billion implied by the CBR’s currency shares. As a result, we effectively assume that the bulk of the frozen assets outside of Euroclear are in dollars and yen, even though it is possible that Russia reduced its dollar share in particular just ahead of the invasion.

If the higher €324 billion total is correct, the CBR’s end-2021 disclosure implies around €180 billion in assets, which would imply the non-Euroclear assets include some additional euros.

Online Store

Online Store